Featuring insights from risk and compliance leaders at Tookitaki, ACAMS, FATF and others.

From NFTs and the Metaverse to new legislation, the finance and compliance space is rapidly changing, requiring financial institutions to be even more prepared. They will be expected to implement sophisticated compliance frameworks capable of meeting ever-changing AML compliance requirements.

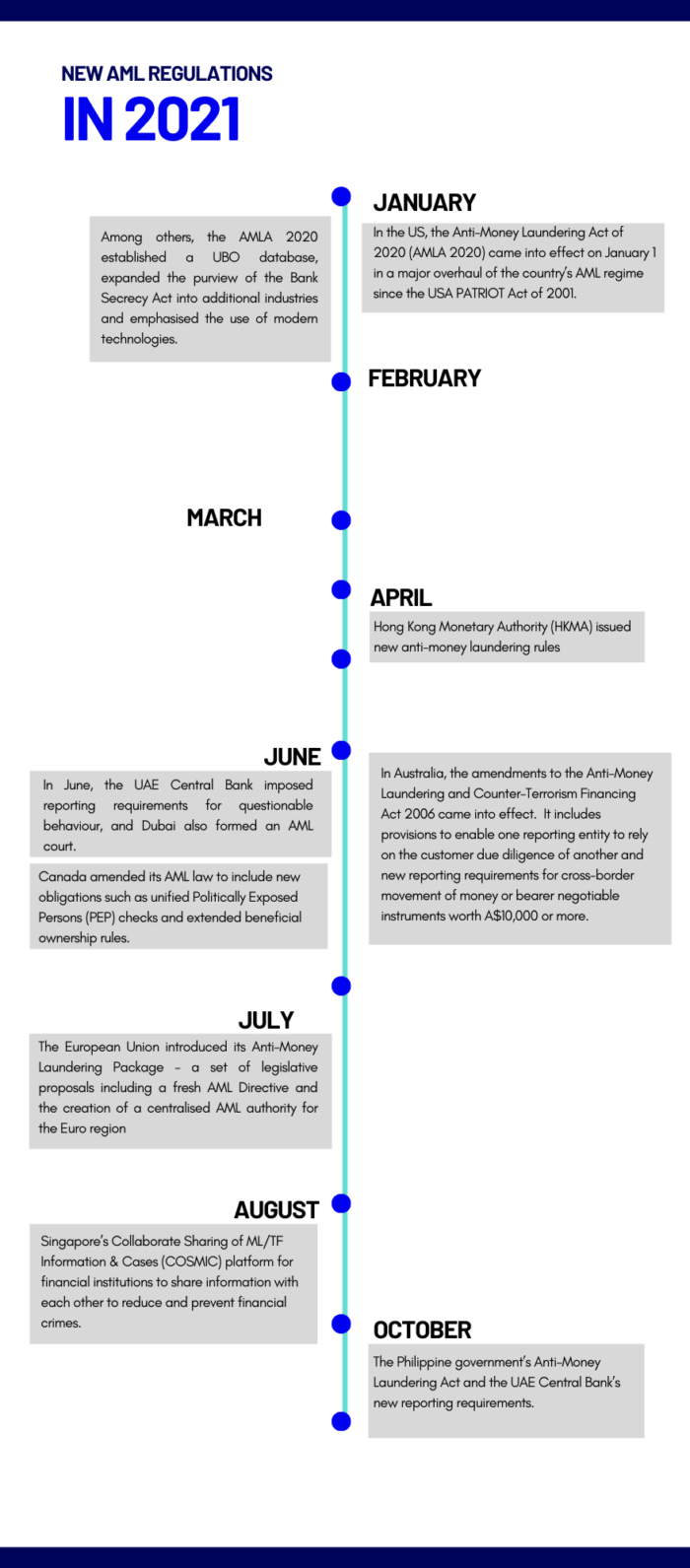

Looking back on 2021, the growing reach of regulatory sanctions has had an impact on enterprises all around the world. Most firms were concerned about the use of financial institutions for money laundering and terrorism funding. In response, global regulatory bodies have emerged with more rigid Anti-Money Laundering (AML) compliance to identify and eliminate the risk of such criminal activities. This year was a watershed moment in AML compliance.

In 2021, we spoke to our customers about their previous AML strategies and experiences as well as how they intended to scale their fraud prevention in the coming years.

We asked them about what was important to them in a compliance programme. As part of these discussions, a few themes kept coming up that we’ve chosen to share the learnings from.

We’ve also used data from industry experts to make predictions about what the AML and RegTech space might look like in the next 12 months.

Looking back: Key learnings from 2021

1. Reforms have been key to regulators

2. Financial crimes have become increasingly prevalent online

While financial services are going increasingly digital, especially during the pandemic, so are financial crimes. Criminals have been adapting their strategies well to fit into the digital avenues. The use of new payment methods and crypto assets for money laundering has been increasing albeit on a smaller scale.

Illicit crypto transaction activity reached an all-time high in 2021, with illicit addresses receiving $14 billion during the year, up from $7.8 billion in 2020, according to blockchain analytics firm ChainAnalysis. While regulators brought companies dealing with cryptocurrencies under their AML rules, these companies are failing to comply with them.

The Financial Conduct Authority in the UK announced in June that an “unprecedented number” of crypto companies had withdrawn applications from a temporary permit scheme in the country. According to media reports, up to 50 companies dealing in cryptocurrencies may be forced to close after failing to meet the UK’s AML rules.

While criminals are quick to adapt to technological advancement with financial transactions such as cryptocurrencies, financial institutions and regulators need to be more proactive to counter the misuse. Regulators around the world should devote attention to developing effective crypto-related legislation and promoting the use of technology to identify crime. Meanwhile, financial institutions should look at technological opportunities to prevent money laundering with these new-age transaction methods.

3. Financial institutions have expressed a desire for more comprehensive AML risk coverage

Rules and thresholds have been less effective for financial institutions as they tried to build compliance programmes in line with increased regulatory requirements and changing customer behaviour. Financial institutions we engaged with have been voicing concerns over operational bottlenecks, rising costs of maintenance and lacklustre effectiveness of their existing solutions for customer due diligence, transaction monitoring and screening.

For example, the US is making moves to slash the suspicious transaction threshold from $3,000 to $250. That means a heavy workload for compliance professionals as any transaction above $250 will need to be investigated.

To address this, financial institutions wanted AML solutions that follow a risk-based approach and are more dynamic and comprehensive in addressing their pressing concerns. With risk factors continuously increasing, rule-based approaches may not be sustainable in the long run. Meanwhile, risk-based approaches that dynamically add context to each and every case can make their compliance programmes future-proof.

4. Regulators continue to encourage the adoption of tech in AML compliance

Regulators across the world have been unanimous in their voice that proper implementation of technology can significantly alleviate the current AML compliance pains of financial institutions. In 2021, we’ve seen more of these encouraging statements from regulators. In January 2021, the Hong Kong Monetary Authority (HKMA) published case studies that highlighted the benefits of adopting RegTech solutions for AML compliance.

Separately, the Financial Action Task Force (FATF), in its June 2021 report titled Opportunities and Challenges of New Technologies for AML/CFT, said “new technologies can improve the speed, quality and efficiency of measures to combat money laundering and terrorist financing.” It added that these technologies can enable secure payments and transactions, enhanced due diligence on high-risk entities, and ongoing transaction monitoring.

Looking ahead: Key predictions for 2022

1. Stricter Crypto Regulations, awareness of NFTs and the Metaverse

Both regulators and businesses have their eyes on cryptocurrency around the world.

According to research from data company Chainalysis, cryptocurrency-based crime reached a new all-time high in 2021, with roughly $14 billion in transactions – up from $7.8 billion in 2020.

According to the research, global cryptocurrency transaction volume surged by 567% to $15.8 trillion in 2021. The 567% rise in transaction volume proves that cryptocurrencies have entered the mainstream.

“As more investors seek financial rewards from this rising asset class, criminals will continue to search for opportunities to exploit, and we predict that crypto-related crime will increase in 2022.” says Abhishek Chatterjee, CEO and founder of Tookitaki.

As a result, improving virtual asset regulation has emerged as a recurring subject. Many regulatory authorities such as FinCEN, SEC, FATF, and other watchdogs have taken an interest in cryptocurrency regulation in the past year. This will continue through 2022.

According to Gou Wenjun, director of the People’s Bank of China’s (PBoC) Anti-Money Laundering (AML) unit, China’s crackdown on cryptocurrencies may extend to NFTs and the metaverse, as both currencies pose several risks, and thus regulatory authorities must maintain “consistent high-level vigilance” on the evolution of digital currencies.

Aside from that, several other governments have taken steps to regulate and mainstream cryptocurrencies, with some, such as China, preparing to create its own digital Yuan. However, by 2022, cryptocurrency exchanges will be required to do AML screening on every customer, a process that will certainly expand to every country in the world in the near future.

2. Beyond the Big Banks: Information Sharing

The Financial Action Task Force (FATF) has urged governments and businesses to collaborate in the fight against money laundering and terrorism funding. Both entities are dealing with the same difficulties, particularly when it comes to information: its reliability, volume, openness, and capacity to be handled effectively.

The FATF says that “data sharing is critical to fight money laundering and the financing of terrorism and proliferation”.

While the trend toward information sharing may take time to catch on, we have already seen the first steps, such as the FinCEN Exchange in the United States, which aims to improve public-private information sharing. However, it is expected to see more similar initiatives in 2022.

In its recent (2021) report titled Stocktake on data pooling, collaborative analytics and data protection, the international agency, which provides the FATF recommendations, notes that with technological advances, financial institutions can analyse large amounts of structured and unstructured data and identify patterns and trends more effectively. The report also lists available and emerging technologies that facilitate advanced AML/CFT analytics and allow collaborative analytics between financial institutions while respecting national and international data privacy requirements.

3. Increased use of Artificial Intelligence and Machine Learning

The importance of continuous improvement of an organisation’s financial transaction monitoring and name screening effectiveness has never been more critical in the digital age and it's predicted that more institutions will adopt AI and ML into their AML programmes.

A study by SAS, KPMG and the Association of Certified Anti-Money Laundering Specialists (ACAMS), surveyed more than 850 ACAMS members worldwide about their use of technology to detect money laundering. 57% of respondents claimed they had already implemented AI or machine learning in their anti-money laundering compliance procedures or are piloting solutions that will be implemented in the next 12-18 months.

According to the study, a third of financial institutions are accelerating their AI and ML adoption for AML purposes. When asked about their AML regulator’s position on the implementation of AI/ML, 66% of respondents said their regulator promotes and encourages these technology innovations.

“As regulators across the world increasingly judge financial institutions’ compliance efforts based on the effectiveness of the intelligence they provide to law enforcement, it’s no surprise 66 per cent of respondents believe regulators want their institutions to leverage AI and machine learning,” said Kieran Beer, chief analyst at ACAMS.

“The pressure on banks to improve their money laundering efforts while addressing Covid-19-related difficulties is expected to be the driving force for the increased usage of AI and ML. Because of the pandemic’s dramatic shift in consumer behaviour, many financial institutions have realised that static, rules-based systems are just not as accurate or flexible as systems that monitor and use criminal behaviour patterns to detect true positives,” said founder and CEO of Tookitaki, Abhishek Chatterjee.

As a result, we predict companies will move away from traditional models.

4. UBO Laws to Have More Transparency

Globally there has been an increasing focus on the need for transparency in business. Many governments have translated the call for openness into formal reporting of beneficial ownership, increasing the need for companies to assess their structure and ensure they meet varying local disclosure requirements.

A key example of this is the Anti-Money Laundering Act of 2020 (AMLA 2020) in the US. Among others, the Act requires certain types of corporate entities that are registered in the country to disclose information regarding UBO, set out by the Corporate Transparency Act (CTA). This is a significant change in terms of transparency as to corporate ownership and will help curb the abuse of company incorporation laws to hide illicit business dealings and money laundering.

We predict banks will implement improved Customer Due Diligence (CDD) measures to reduce financial crimes as transparency increases.

Some countries have embraced these laws. However, because certain countries, such as Switzerland, do not intend to embrace UBO legislation, criminals in these countries will have easy access to shell companies next year. It is expected that money laundering and other financial crimes would skyrocket in these countries.

5. A seamless online customer onboarding experience will become key

Research carried out by Finextra with the AITE Group in 2018 found that 13 billion data records were stolen or lost in the US since 2013, which in turn is driving increased application fraud that’s set to cost banks in the US $2.7 billion in credit card and DDA loses in 2020, up from £2.2 billion in 2018. This is a global problem, with the UK fraud prevention organisation Cifas stating that during the previous several years, its members have reported around 175,000 incidents of identity theft every year.

As the cost of financial crime rises, so does the demand on banks to reduce friction when communicating with clients. This is due to the fact that, in the digital age, customer expectations are influenced by their interactions with digital behemoths such as Apple and Amazon. This increases the pressure on those in financial services to provide equally frictionless online experiences, with the importance of simplicity of use beginning with onboarding.

Therefore, it was perhaps not surprising when Finextra asked about key business case drivers for new account risk assessment tools, top of the list for fraud executives at banks, at 88%, were those that improve the customer onboarding experience, according to their research.

Therefore, client onboarding that is frictionless and doesn’t compromise on AML requirements is no longer an alternative; it is a need.

Final Thoughts

Money launderers and cybercriminals will continually devise new ways to exploit the financial industry in order to carry out illegal operations. The most challenging component, however, is discovering illicit activity in time while including a comprehensive AML framework to trace, detect, and eradicate the possible danger of money laundering, terrorism financing, and other financial crimes. Understanding criminal behaviour patterns at the root is key.

Do you want to learn more about AML compliance services for your company? Reach out to us.

Anti-Financial Crime Compliance with Tookitaki?