Typology Tales: Early Loan Repayments Exceeding Declared Client Income

Money laundering is a complex financial crime where illegal funds are made to appear legal, moving through various transactions to hide their illicit origins. As fraudsters continually refine their strategies to outmaneuver detection, the tactics used in money laundering have become increasingly sophisticated. This evolution requires financial institutions to stay alert and adapt their monitoring techniques to catch these advanced schemes.

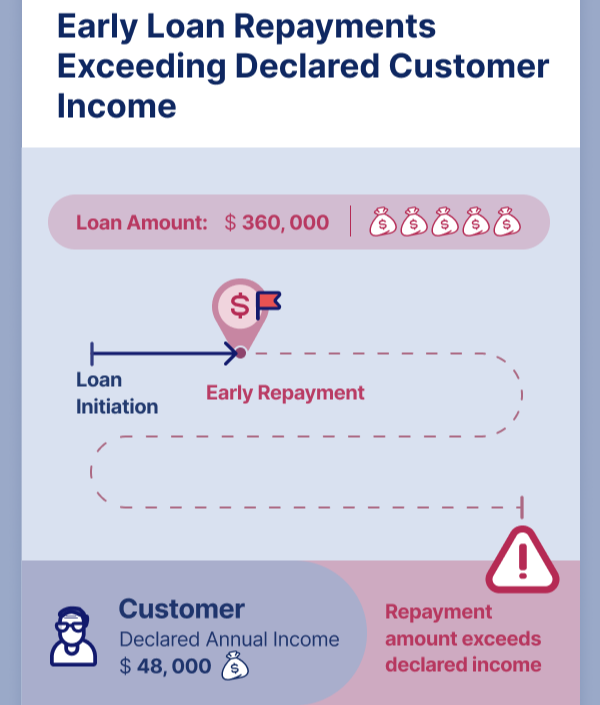

One such sophisticated method, identified through Tookitaki's Anti-Financial Crime (AFC) Ecosystem, involves early loan repayments that significantly exceed a customer's declared income. This typology is a critical red flag, suggesting that a customer might be attempting to launder money by injecting it into the financial system as seemingly legitimate loan repayments. Understanding and identifying this typology is essential for institutions aiming to prevent and detect money laundering effectively.

Understanding the Typology

How It Works

- Customers initiate early repayments on loans with sums significantly larger than their reported or declared income. This could involve a single substantial payment or a series of payments that, collectively, are out of proportion to the customer's known financial capacity.

- These repayments are characterized by an unusually high sum and frequency of incoming transactions that do not match the customer's established income pattern. The transactions are often completed without a corresponding increase in the customer's income sources, raising suspicions about the origin of the funds used for repayment.

Significance of the Discrepancy

- Indicator of Money Laundering: The stark discrepancy between the customer's declared income and the amount used for early loan repayment is a red flag for potential money laundering activities. It suggests that the customer may be using the loan as a conduit to introduce illicit funds into the financial system, disguising them as legitimate transactions.

- Layering Stage of Money Laundering: This activity typically occurs in the layering phase of money laundering, where launderers attempt to obscure the origin of illicit funds through complex financial transactions. Early loan repayments exceeding customer income can serve as a mechanism to "clean" dirty money by integrating it into the financial system as if it were a legitimate repayment of a loan.

- Necessity for Vigilant Monitoring: Financial institutions must be vigilant in monitoring for such discrepancies. Automated systems and thorough checks are essential to identify and investigate instances where loan repayments do not align with the known financial profile of the customer, serving as an early warning system against potential money laundering schemes.

The Mechanism Explained

The process of laundering money through early loan repayments exceeding declared customer income unfolds in several steps, starting with the initial deposit of funds into the financial system. Firstly, a customer begins by making substantial early repayments on a loan, using amounts that are significantly larger than their declared or known income. This activity typically involves a series of transactions that, due to their size and frequency, do not match the customer's income pattern, raising the first set of red flags for potential illicit activity.

A Growing Concern

This typology has become a growing concern for financial institutions due to its occurrence across a broad spectrum of customer segments and loan types. Whether it’s corporate entities, SMEs, MSMEs, sole proprietors, partnerships, or retail banking customers, this method's applicability across different financial instruments makes it a versatile tool for launderers.

Why It’s Alarming

The versatility and subtlety of this method pose significant challenges for detection and prevention. Its application across various loan products, from mortgages to personal loans, and its occurrence among diverse customer segments, underline the necessity for financial institutions to adapt their monitoring and investigative approaches continually. This typology's ability to blend illicit funds so seamlessly into the financial system underlines the critical need for enhanced vigilance, sophisticated detection systems, and comprehensive understanding and analysis of customer financial behaviors.

Identification and Monitoring Challenges

Financial institutions face significant challenges in identifying typologies like early loan repayments exceeding declared income, primarily due to the high volume and frequency of transactions that can mask these illicit activities. The discrepancy between the transactions and customer income patterns requires sophisticated analytical tools and algorithms to detect anomalies effectively. Additionally, the sheer volume of daily transactions that banks process can make it difficult to pinpoint suspicious activities without generating a substantial number of false positives, complicating the monitoring process.

The importance of vigilantly monitoring these transactions extends beyond the prevention of money laundering, as these activities could potentially be linked to more severe crimes, including terrorism financing. The ability to inject illicit funds into the financial system under the guise of legitimate transactions presents a significant risk, not only to the integrity of the financial institution but also to national and global security. Therefore, the development and implementation of advanced monitoring systems that can accurately identify and flag such typologies are crucial for financial institutions to contribute effectively to the broader fight against financial crimes.

The Role of the AFC Ecosystem

Tookitaki's Anti-Financial Crime (AFC) Ecosystem serves as an indispensable tool for financial institutions committed to identifying and combating sophisticated money laundering typologies, such as early loan repayments that far exceed a customer's declared income. This innovative ecosystem leverages the collective knowledge and experience of its members, enhanced by advanced analytics, to uncover and understand complex patterns of financial crime. Membership in the AFC Ecosystem offers access to a wealth of unique typologies, shedding light on emerging threats and providing actionable insights that significantly improve the effectiveness of fraud prevention and detection efforts.

Financial crime enthusiasts and institutions are strongly encouraged to join the AFC Ecosystem. By doing so, they tap into community-driven insights and employ advanced analytical tools that are essential for staying one step ahead of fraudsters and their continuously evolving tactics. The collaborative nature of the AFC Ecosystem not only broadens the understanding of financial crime mechanisms but also fosters a proactive approach to safeguarding the financial system.

Anti-Financial Crime Compliance with Tookitaki?