The Power of Typologies: Mitigating Regulatory Risks in Finance

In today's ever-evolving regulatory landscape, financial institutions face a relentless stream of challenges and complexities. Regulatory requirements, designed to combat financial crime, continually shift and expand, demanding robust solutions to ensure compliance. Amidst this dynamic environment, typologies emerge as invaluable assets in the arsenal of regulatory risk mitigation. These finely tuned patterns and profiles provide financial organizations with the capability to navigate the regulatory maze effectively. But the story doesn't end there. The AFC Ecosystem, with its mission to transform and elevate compliance operations, plays a pivotal role in ensuring that typologies remain at the forefront of regulatory risk management.

Evolving Regulatory Landscape

The regulatory landscape in the world of anti-money laundering (AML) and fraud detection has undergone a remarkable transformation. Regulatory authorities worldwide have intensified their efforts to combat financial crimes, forcing financial institutions to adapt rapidly. With stringent regulations and heightened scrutiny, staying compliant has become more intricate than ever before. These regulatory changes, often driven by new risk patterns and evolving criminal tactics, necessitate innovative approaches for risk mitigation. Typologies, as adaptable and agile tools, have stepped up to the challenge, offering financial organizations the means to stay ahead of regulatory pitfalls. In this blog, we'll explore the pivotal role that typologies play in mitigating regulatory risks, spotlighting real-world cases where they've proven effective. Moreover, we'll delve into the mission of the AFC Ecosystem—a dynamic platform poised to revolutionize compliance operations and empower institutions to meet global regulatory changes head-on.

The Power of Typologies

Defining Typologies in Compliance

Typologies, in the realm of compliance, are structured models that define various characteristics, behaviors, and patterns associated with illicit financial activities. They provide a systematic framework for identifying and assessing potentially suspicious activities. These models encompass a wide array of financial transactions, relationships, and profiles, enabling organizations to establish red flags for potential risks. Typologies act as a sort of financial detective, creating profiles of potential criminals and their activities to aid in early detection and prevention. Their strength lies in their adaptability to the ever-changing tactics employed by money launderers, fraudsters, and other financial criminals.

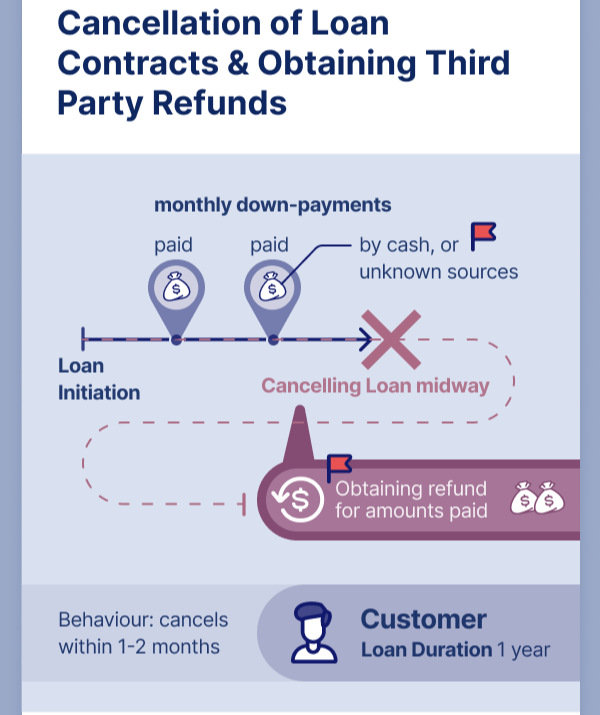

An illustration of a typology is given below:

How Typologies Prevent Pitfalls

Typologies play a fundamental role in mitigating regulatory risks by serving as advanced surveillance mechanisms.

- They analyze massive volumes of transaction data, customer profiles, and market trends to pinpoint potential risks.

- By identifying unusual patterns or anomalies, typologies enable early intervention, allowing organizations to report and mitigate suspicious activities promptly.

- This proactive approach not only ensures compliance but also safeguards institutions against regulatory penalties and reputational damage.

- Through typologies, financial institutions can act swiftly and decisively to prevent money laundering, fraud, and other illicit financial activities.

Transforming Compliance with AFC Ecosystem

The AFC (Anti-Financial Crime) Ecosystem represents a paradigm shift in the world of compliance. It is a dynamic and collaborative platform designed to unite financial institutions, regulatory bodies, and experts in the common mission of combating financial crime and mitigating regulatory risks. At its core, the AFC Ecosystem harnesses collective intelligence and shares it across a global network, empowering institutions to tackle complex compliance challenges proactively. This platform is the embodiment of a community-driven approach to compliance.

AFC Network and Collaboration

One of the hallmarks of the AFC Ecosystem is its expansive network of AML (Anti-Money Laundering) professionals, experts, and organizations. Within this network, collaboration thrives as members pool their collective knowledge, insights, and typologies to strengthen the industry's defenses against financial criminals. Through open channels of communication and collaboration, the AFC Network fosters a sense of shared responsibility in safeguarding the financial sector from illicit activities. Collaboration is the cornerstone of effective typology development and regulatory risk mitigation within the AFC Ecosystem.

Typology Repository for Enhanced Compliance

Central to the AFC Ecosystem's capabilities is the Typology Repository, a comprehensive database of typologies contributed by industry experts and organizations. This repository acts as a treasure trove of regulatory intelligence, housing proven typologies designed to detect and prevent a wide range of financial crimes. By tapping into this extensive repository, financial institutions gain access to a wealth of typological knowledge and tools to bolster their compliance operations. The Typology Repository is the linchpin that ensures that organizations are equipped with the latest and most effective typologies, thus enhancing their compliance efforts and regulatory risk mitigation strategies. In the subsequent sections, we will explore real-world examples of how the AFC Ecosystem, in tandem with typologies, has transformed compliance operations and effectively mitigated regulatory risks.

Becoming a Part of the Mission

The mission of the AFC Ecosystem is not limited to a select few; it is a call to action for all AML professionals, financial institutions, and experts across the globe. By becoming a part of this transformative community, you contribute to the collective intelligence needed to combat financial crime and mitigate regulatory risks. Joining the AFC Ecosystem is a commitment to driving change, fostering collaboration, and advancing the state of compliance. Your expertise and insights are invaluable assets in this mission, and your active participation is encouraged.

Staying Prepared for Regulatory Changes

The regulatory landscape is in a constant state of evolution. New compliance requirements and risks emerge regularly. By engaging with the AFC Ecosystem, you position yourself and your organization to stay ahead of these changes. The collective intelligence and typologies shared within the community serve as a proactive defense against unforeseen regulatory pitfalls. Instead of merely reacting to regulatory updates, AFC Ecosystem members are prepared to navigate them confidently. It's a proactive approach to compliance that can save both time and resources while ensuring adherence to the latest standards.

Joining the AFC Community

The AFC Ecosystem is more than a platform; it's a vibrant and dynamic community of like-minded professionals and organizations dedicated to making a difference in the world of compliance. Joining this community means gaining access to a wealth of knowledge, collaborative opportunities, and the shared mission of mitigating regulatory risks. Together, we can transform compliance operations, create more resilient institutions, and build a financial sector that is less vulnerable to illicit activities. In the following sections, we will delve into real-world cases that highlight the significant impact of typologies and the AFC Ecosystem on mitigating regulatory risks. It's time to be a part of this transformative journey.

The Future of Compliance with AFC Ecosystem

As we conclude our exploration of typologies as regulatory risk mitigators and the pivotal role of the AFC Ecosystem, it's essential to look ahead. The future of compliance is marked by dynamic regulatory changes and evolving financial crime tactics. However, it's also a future brimming with opportunities for innovation, collaboration, and resilience. The AFC Ecosystem, with its community-driven approach and powerful typologies, represents a beacon of hope in this changing landscape.

In the coming years, compliance will not be just a regulatory requirement; it will be a strategic asset. Organizations and professionals that embrace this transformation will find themselves better equipped to navigate regulatory challenges, protect their institutions, and seize strategic opportunities. The AFC Ecosystem's mission is not only to mitigate regulatory risks but also to empower its members to thrive in an ever-evolving financial ecosystem.

Join the AFC Mission

The journey towards a more secure, compliant, and innovative financial sector begins with you. We invite AML professionals, financial institutions, and experts to join the AFC Ecosystem's mission. Your expertise, insights, and collaboration are crucial in driving change and building a resilient global financial system. Together, we can harness the power of typologies and collective intelligence to stay ahead of regulatory risks and create a safer financial future for all. Join the AFC Ecosystem today and be a part of this transformative mission. Together, we can build a brighter future for compliance and financial integrity.

Anti-Financial Crime Compliance with Tookitaki?