Tackling Money Laundering in South Africa: A Comprehensive Approach

As the global financial landscape becomes more interconnected and complex, money laundering has emerged as a major issue that continues to pose significant challenges to economies worldwide. With its dynamic economy and robust financial sector, South Africa is not immune to this problem. Money laundering in the country has seen an uptick in recent years, driven by technological advancements, cross-border transactions, and a diversified criminal landscape.

Money laundering, in essence, is a process where 'dirty money' derived from illicit activities is transformed into 'clean money,' giving it the appearance of having been obtained from legitimate sources. Apart from fueling other illegal activities, this crime has substantial negative impacts on the economy. It distorts economic data, fuels corruption, compromises governance, and hampers the nation's overall development.

In order to effectively tackle this pervasive problem, a comprehensive approach is required. Such an approach does not solely focus on one aspect of the issue. Still, it seeks to address it from multiple fronts - strengthening legal frameworks, leveraging technology, fostering international cooperation, and raising public awareness about the perils of money laundering.

This blog will delve into the current state of money laundering in South Africa, explore the essence of a comprehensive approach, and discuss how innovative solutions like Tookitaki's Anti-Financial Crime (AFC) Ecosystem can play a crucial role in this fight against money laundering. The need of the hour is a coordinated, comprehensive strategy, and it is time South Africa steps up its game in the fight against financial crime.

The State of Money Laundering in South Africa

The Current Situation and Prominent Cases

With its robust economy and complex financial systems, South Africa has unfortunately become a fertile ground for money laundering activities. Criminals exploit various sectors such as banking, real estate, and trade to launder money, taking advantage of the intricacies involved in these sectors to obscure the illicit origins of funds.

Prominent cases such as the infamous Gupta family scandal, where billions of rands were allegedly laundered, have highlighted the severity of the problem. In another case, South African banks were found to have facilitated transactions linked to the "Mozambique hidden debts" scandal, involving approximately $2 billion.

Prevalent Methods of Money Laundering

Criminals employ a variety of methods to launder money in South Africa:

- Trade-Based Money Laundering: This involves over or under-invoicing of goods and services, multiple invoicing, and over or under-shipment of goods, among other methods.

- Digital Money Laundering: The use of cryptocurrencies, online gaming, and digital payment systems can obscure the origin of illicit funds.

- Real Estate Money Laundering: Purchasing property with illicit funds and then selling it allows criminals to legitimize the money.

The Impact of Money Laundering

Money laundering poses serious threats to South Africa's economy and society:

- Economic Impact: It distorts the economy, discourages foreign investment, and leads to unsustainable economic growth. The funds laundered could be used for productive economic activities rather than being stashed away or moved out of the country.

- Social Impact: Money laundering fuels other crimes and corruption, leading to social instability. It undermines the rule of law and erodes public trust in institutions.

- Impact on Governance: When illicit funds infiltrate the political sphere, they can compromise governance, undermine democracy, and contribute to policy distortion.

In the face of such a pervasive problem, it becomes clear that a comprehensive approach is needed to combat money laundering in South Africa effectively. This includes enhancing legal frameworks, leveraging technology, promoting international cooperation, and raising public awareness.

A Comprehensive Approach to Tackling Money Laundering

In the fight against money laundering, a siloed or narrow approach can be ineffective due to the complex, multifaceted nature of the crime. A holistic, multi-pronged strategy that addresses all aspects of the problem is needed. This is where a comprehensive approach comes in. Working on multiple fronts simultaneously can significantly enhance our capacity to tackle this pervasive issue.

Here are the key elements that constitute a comprehensive approach:

- Legal Framework: Robust legal measures are the backbone of any effective anti-money laundering strategy. South Africa needs to continually update and enforce its legislation to counter money laundering, taking into account evolving tactics and new forms of illicit finance. Legal measures should extend to rigorous oversight and regulation of financial institutions and non-financial businesses and high penalties for non-compliance.

- Technology: Technology has a crucial role to play in detecting, preventing, and disrupting money laundering. Advanced analytical tools can sift through vast amounts of data to identify suspicious patterns that human investigators might miss. Machine learning and AI can enhance the efficiency and accuracy of these tools, enabling real-time detection of suspicious activities.

- International Cooperation: Money laundering is often transnational in nature, making international cooperation indispensable. Countries need to share intelligence, harmonize their regulatory frameworks, and assist each other in investigations and prosecutions. Regional bodies and global platforms can facilitate such cooperation.

- Public Awareness: Public awareness is another important element. The more the general public understands money laundering, the less likely they are to unwittingly facilitate it. Awareness campaigns can inform people about how money laundering works, the signs to look for, and the channels to report suspicious activities.

Challenges to Implementing a Comprehensive Approach

While the importance of a comprehensive approach is evident, implementing it in South Africa is not without challenges. Some of the major obstacles include:

- Insufficient Regulatory Compliance: Despite having robust anti-money laundering laws, compliance can be a challenge. Financial institutions and other entities may lack the necessary resources or expertise to comply with these regulations fully.

- Technological Limitations: While technology can be a powerful tool in the fight against money laundering, its potential is often underutilized due to a lack of technical expertise, resources, or understanding of its benefits.

- International Cooperation Issues: Achieving effective international cooperation can be complicated by jurisdictional issues, differing legal frameworks, and lack of trust or established channels for sharing information.

- Public Apathy: Public awareness of money laundering and its detrimental effects can be low, leading to apathy or lack of vigilance.

Tookitaki's AFC Ecosystem: An Integral Part of a Comprehensive Approach

In the face of the multifaceted challenges posed by money laundering, innovative solutions like Tookitaki's Anti-Financial Crime (AFC) Ecosystem have emerged as crucial tools to support a comprehensive approach. The AFC Ecosystem is a community-based platform designed to facilitate information sharing and the application of best practices in combating financial crime.

The AFC Network and Typology Repository

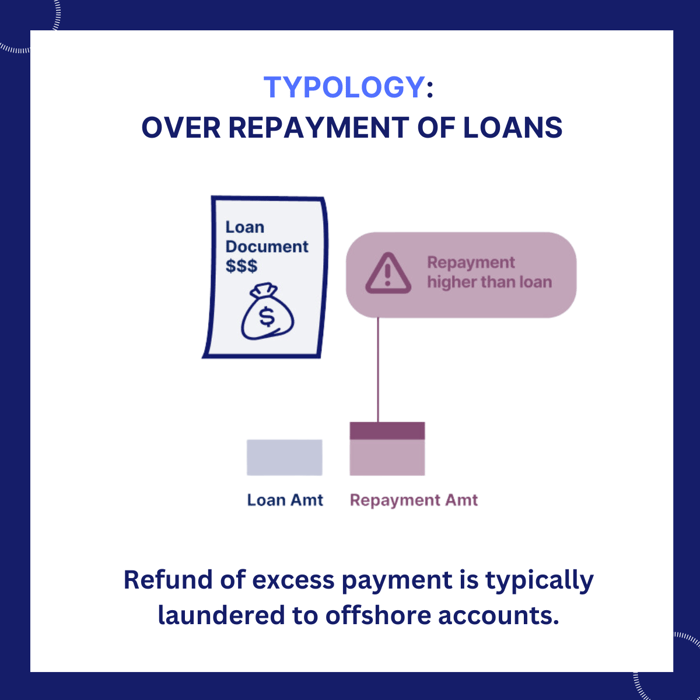

The AFC Ecosystem comprises two main components: the AFC Network and the Typology Repository. The AFC Network is a global assembly of subject matter experts who contribute the latest typologies, while the Typology Repository is a vast, federated database of money laundering patterns contributed and validated by experts.

The Typology Repository, operating solely on patterns and not storing any data, ensures complete privacy protection. It is a readily accessible and exhaustive database that allows members of the network to search for typologies and integrate them into their anti-money laundering systems with a single click.

A typology representation is shown below.

Features and Benefits

Some of the key features of the AFC Ecosystem include:

- A no-code, drag-and-drop rule creation UI within the Typology Developer Studio

- Regular updates with the latest emerging trends in money laundering

- Ability to categorize and manage typologies under various categories for easy search and download

- Privacy protection with no storage of customer personally identifiable information or client-sensitive data

The adoption of the AFC Ecosystem can greatly enhance the fight against money laundering in South Africa. By joining a community of experts, institutions can stay ahead of the latest developments in financial crime. The sharing of knowledge and best practices can help uncover hidden risks, and the advanced technological tools can make compliance a strategic advantage, opening up new business opportunities.

Tookitaki's AFC Ecosystem and Its Potential Impact in South Africa

Given South Africa's challenges in combating money laundering, the AFC Ecosystem by Tookitaki can offer a much-needed solution that caters to the country's specific issues. Here's how:

- Addressing Compliance Hurdles: The AFC Ecosystem’s Typology Repository and Developer Studio can help South African institutions better understand, adapt to, and comply with local and international regulatory standards. The 'No Code' drag-and-drop rule creation interface simplifies the process of implementing and managing complex regulatory rules, which can help institutions meet compliance requirements more effectively.

- Enhancing Technology Utilization: The AFC Ecosystem collaborates with Tookitaki's Anti-Money Laundering Suite that leverages advanced technology to detect and prevent financial crimes. By adopting this system, South African institutions can access a cutting-edge tool that can significantly enhance their anti-money laundering efforts. The constant updating of the Typology Repository ensures that the technology remains responsive to the evolving tactics of money launderers.

- Facilitating International Cooperation: The AFC Network provides a platform for international cooperation, with a community of experts from around the globe sharing their knowledge and experiences. This global connectivity can help South African institutions better understand international trends and collaborate on cross-border investigations.

- Boosting Public Awareness: The extensive knowledge base available through the AFC Ecosystem can also serve as a resource for public awareness initiatives. By educating the public on the various typologies of money laundering, South African institutions can help increase public vigilance and reporting.

In conclusion, Tookitaki's AFC Ecosystem has the potential to provide a major boost to South Africa's efforts to combat money laundering. By facilitating information sharing, offering advanced technological tools, and connecting South African institutions to a global network of experts, it can play a crucial role in a comprehensive approach to tackling this pervasive issue.

Stepping Up the Fight: A Call to Action

As we have seen, money laundering significantly threatens South Africa's economy and societal stability. Addressing this problem requires a comprehensive approach that combines effective legislation, technological innovation, international cooperation, and public awareness. Unfortunately, implementing such an approach has proven to be a complex challenge due to various barriers.

This is where Tookitaki's AFC Ecosystem come in. With its global network of experts and vast typology repository, the AFC Ecosystem can empower South African institutions to stay ahead of financial criminals. By facilitating effective information sharing, the system can help to uncover hidden risks and update compliance processes with the latest trends in money laundering.

The potential positive impact of adopting this system is significant. It can help to strengthen the country's defences against money laundering, contribute to economic stability, and help South Africa to meet its international obligations in the fight against financial crime. Additionally, by turning compliance into a strategic advantage, it can open up new business opportunities and enhance the competitiveness of South African institutions.

We thus call on all anti-financial crime experts, regulatory bodies, financial institutions, and risk consultants in South Africa to explore the potential of Tookitaki's AFC Ecosystem. By joining this community-based platform, we can strengthen our collective capacity to combat money laundering and ensure a safer, more secure financial environment for all. The fight against money laundering is a shared responsibility – let's step up to this challenge together.

Anti-Financial Crime Compliance with Tookitaki?