Battling Authorized Push Payment Scams with the AFC Ecosystem

In recent years, the financial world has seen a sharp rise in Authorized Push Payment (APP) scams, where individuals are tricked into sending money to fraudsters under false pretenses. These scams have not only resulted in significant financial losses for many but have also highlighted vulnerabilities in the current systems designed to protect against financial crime. As these scams become more sophisticated, the need for innovative solutions to combat them has never been more critical.

Enter Tookitaki's Anti-Financial Crime (AFC) Ecosystem, a groundbreaking approach aimed at revolutionizing how financial institutions fight against such deceptive practices. By leveraging collective intelligence and offering comprehensive risk coverage, the AFC Ecosystem empowers banks and fintech companies to stay ahead of financial criminals. This ecosystem stands as a testament to Tookitaki's commitment to redefine the financial landscape by providing advanced solutions for detecting and preventing financial crimes, ensuring a safer financial environment for all.

Understanding Authorized Push Payment (APP) Scams

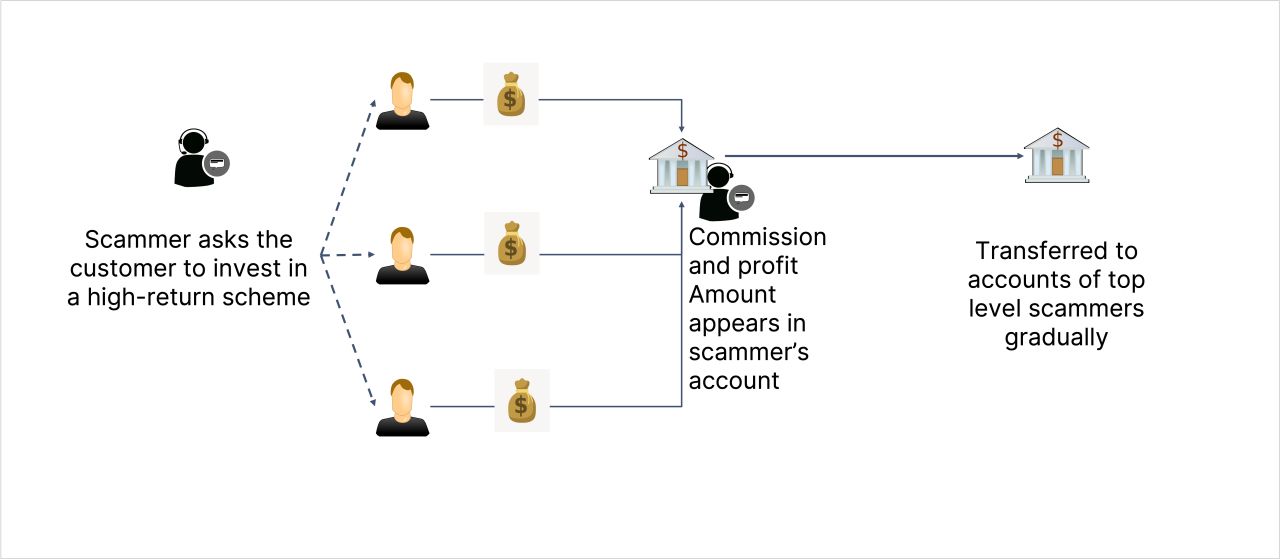

Authorized Push Payment (APP) scams occur when individuals are deceived into voluntarily sending money to a scammer, often believing they are making a legitimate payment to their bank or another trusted entity. These scams are sophisticated, leveraging social engineering techniques to create a sense of urgency or fear, convincing victims to act quickly. Scammers might pose as bank officials, law enforcement, or representatives from other trusted organizations, crafting believable narratives that prompt immediate financial action from their targets.

The financial impact of APP scams is both staggering and growing. In recent years, these scams have accounted for a significant portion of payment fraud losses worldwide. For instance, in 2022, it was reported that 39% of all payment fraud losses stemmed from APP scams. With losses set to double by 2026, the financial toll on individuals and institutions is not only substantial but also highlights an urgent need for more effective prevention strategies. This alarming trend underscores the critical necessity for innovations in financial crime prevention, such as Tookitaki's AFC Ecosystem, to combat these sophisticated scams.

The Cost of Complacency

The repercussions of APP scams extend far beyond the immediate financial losses experienced by individuals; financial institutions also face substantial consequences. When customers fall victim to such scams, not only do banks incur direct financial losses through reimbursements, but they also suffer significant reputational damage. The trust that customers place in their banks is foundational, and when that trust is breached through scams, restoring it can be a long and arduous process. This reputational damage can lead to a loss of customer confidence, reduced client retention, and difficulty in attracting new business, impacting the institution's financial health and competitive standing in the market.

Recognizing the importance of proactive measures in the battle against financial crime is crucial for mitigating these risks. Financial institutions that invest in advanced detection and prevention strategies, like Tookitaki's AFC Ecosystem, demonstrate a commitment to safeguarding their customers' financial well-being. This proactive stance not only enhances their ability to thwart APP scams and other financial crimes but also strengthens their reputation as secure and trustworthy entities. In today's digital age, where financial crimes are increasingly sophisticated, adopting a forward-thinking approach to financial crime prevention is indispensable for maintaining a strong customer base and ensuring long-term institutional resilience.

The Role of the AFC Ecosystem in Combatting APP Scams

Tookitaki's Anti-Financial Crime (AFC) Ecosystem represents a pioneering approach to combating financial crimes, including APP scams. At its core, this ecosystem utilizes a unique combination of collective intelligence and cutting-edge technology to offer unparalleled risk coverage and fraud detection capabilities. By integrating real-time data analytics, machine learning, and the shared expertise of a global network of financial crime specialists, the AFC Ecosystem delivers a dynamic and proactive defense mechanism against the evolving threat landscape. This innovative approach not only anticipates potential scams but also adapts to new tactics employed by fraudsters, ensuring that financial institutions are always one step ahead in the fight against financial crime.

Central to the AFC Ecosystem's success is its ability to foster collaboration and knowledge sharing among financial institutions, regulators, and other stakeholders. Through this collaborative platform, participants can exchange insights on emerging scam typologies, share best practices for fraud detection and prevention, and collectively enhance their defenses against APP scams and other financial crimes. This shared knowledge base enables the rapid dissemination of critical information, ensuring that all members of the ecosystem are equipped with the latest intelligence to protect their customers and assets effectively. By empowering institutions to work together in this way, Tookitaki's AFC Ecosystem not only amplifies individual efforts but also strengthens the collective ability of the financial community to combat financial crime on a global scale.

Implementing Effective Strategies Against APP Scams

To combat the rising tide of Authorized Push Payment (APP) scams, financial institutions can adopt a multifaceted strategy leveraging Tookitaki's Anti-Financial Crime (AFC) Ecosystem. This approach involves enhancing detection capabilities, understanding and responding to unusual transaction patterns, and applying additional scrutiny to high-risk transactions. Below are best practices for utilizing the AFC Ecosystem effectively.

Monitoring Excessive Amount Transactions

One effective strategy is to monitor transactions involving excessively large amounts of money. Scammers often manipulate victims into transferring large sums, which can be a red flag for potential APP scams. Financial institutions can use the AFC Ecosystem to set thresholds for what constitutes an "excessive amount" based on current fraud trends and customer behavior patterns. Transactions exceeding these thresholds should trigger immediate review and verification processes to confirm their legitimacy.

Watching for Unusual Transaction Patterns

Unusual transaction patterns, such as sudden spikes in activity or transfers to previously unknown accounts, can indicate fraudulent activity. Financial institutions should employ advanced analytics and machine learning tools available through the AFC Ecosystem to identify and flag these anomalies. Continuous learning and adaptation are key, as fraudsters constantly evolve their tactics. Incorporating real-time data and community-shared intelligence into monitoring systems enables institutions to stay ahead of scammers.

Implementing Extra Checks for Urgent, Large Transfers

For transactions marked by urgency and significant value—two characteristics commonly exploited in APP scams—implementing extra verification checks is crucial. This might include multi-factor authentication, direct contact with the customer via a known phone number, or a cooling-off period to give the customer time to consider the transaction further. The AFC Ecosystem can provide insights into effective verification techniques and customer communication strategies that balance security with user experience.

By integrating these strategies and leveraging the collaborative power of the AFC Ecosystem, financial institutions can significantly enhance their defenses against APP scams. The key to success lies in the synergy between technological innovation, shared knowledge, and proactive risk management practices.

Beyond APP Scams - A Comprehensive Approach to AFC

The fight against Authorized Push Payment (APP) scams is just one facet of a broader challenge facing today's financial institutions: the need for a holistic Anti-Financial Crime (AFC) strategy. The implementation of the AFC Ecosystem by Tookitaki represents a paradigm shift in how the financial industry approaches crime prevention. By fostering a collaborative environment, the ecosystem allows for a dynamic, collective response to not just APP scams but all forms of financial crime, thereby enhancing the overall resilience of the financial sector.

A comprehensive AFC strategy extends beyond addressing specific types of scams or fraudulent activities. It involves an integrated approach that encompasses the prevention, detection, and investigation of a wide range of financial crimes, leveraging the power of collective intelligence and advanced technological solutions. The ongoing development of the AFC Ecosystem is pivotal in this context, as it continuously evolves to address new challenges and threats. Through machine learning, artificial intelligence, and community-driven insights, the ecosystem adapts to changing patterns of crime, ensuring that financial institutions remain equipped with the most effective tools for safeguarding their operations and their customers.

The importance of combating APP scams underscores the broader imperative of investing in innovative solutions like the AFC Ecosystem. Financial crime not only inflicts immediate financial losses but also erodes trust in the financial system as a whole. By participating in the AFC Ecosystem, financial institutions can benefit from and contribute to a collective defense mechanism, thereby playing a crucial role in shaping the future of financial crime prevention. This collaborative effort is essential for staying ahead of increasingly sophisticated criminals and protecting the integrity of the global financial landscape.

Anti-Financial Crime Compliance with Tookitaki?